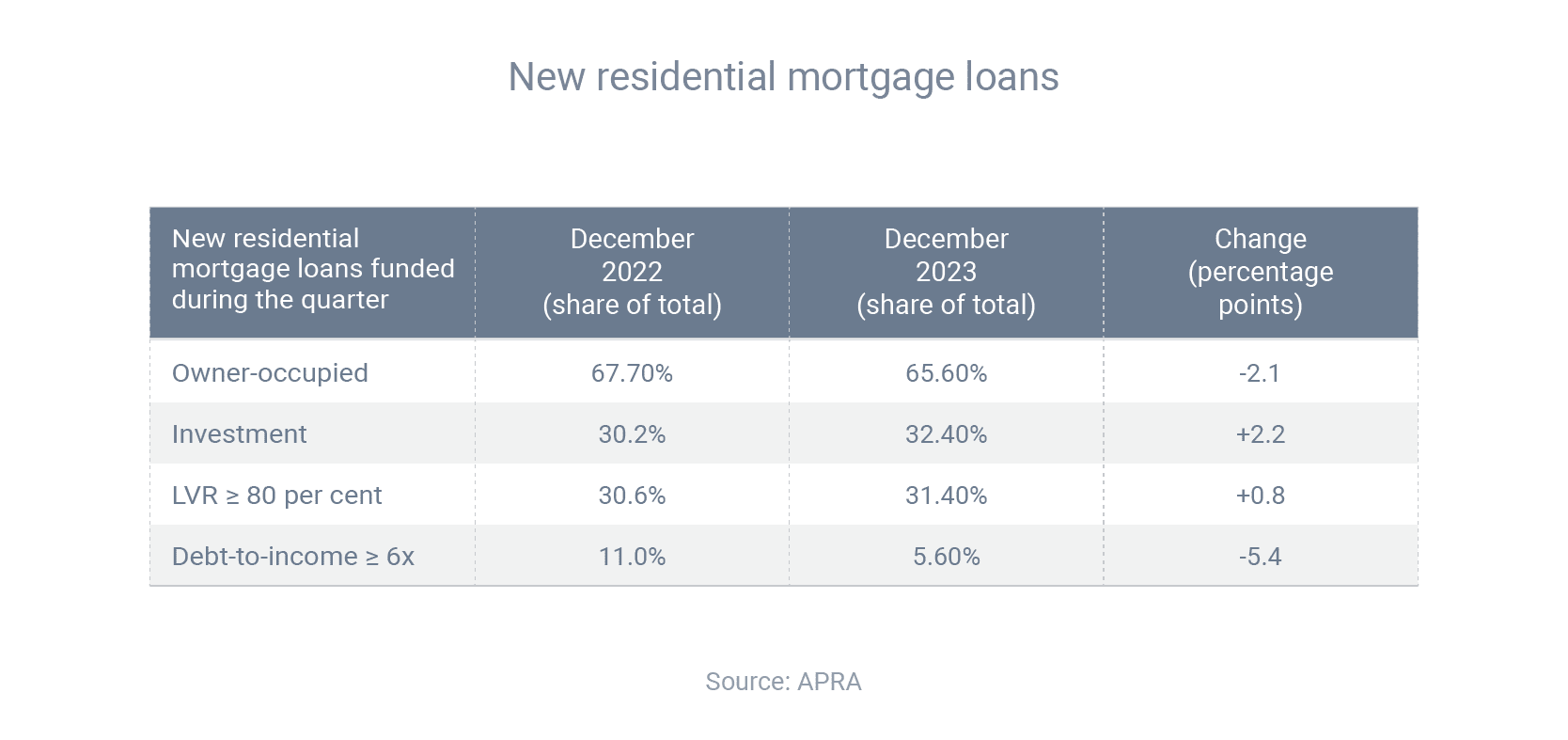

The latest tranche of home loans data from the banking regulator, APRA, has revealed three interesting shifts in the mortgage market over the past year.

First, there’s been a meaningful rise in investor activity during that time. During the December 2022 quarter, 30.2% of new loans were for investment purposes; but in the December 2023 quarter, the share increased to 32.4%. There’s been a corresponding decline in owner-occupier activity, which fell from 67.7% to 65.6%.

Second, there’s been a sharp decline in borrowing with a debt-to-income of 6 or greater (e.g. someone on a $100,000 salary borrowing $600,000 or more). This fell from a 11.0% share of new loans in December 2022 to only 5.6% in December 2023.

Finally, the share of borrowing with a loan-to-value ratio of 80% or higher has actually increased, from 30.6% of new loans in December 2022 to 31.4% in December 2023.

Whether you’re an owner-occupier or investor, we can advise you about your borrowing power and help you get a great home loan.